January 20 2021 at 833 pm. Previous year defined CHAPTER-II Basis of charge Section 4.

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax

As per Section3 of Income Tax Act 1961 the term previous year means the financial year immediately preceding the assessment year.

. Can i recive gift of 25 lacs from my brother sons. Sections 43 to 80. 10- Income Tax Returns under Section 1395 of Income Tax Act 1961 can be revised when filed pursuant to notice under Section 148 as it is provided us 148 that for such return all the provisions of section 139 shall apply.

As per S234 of Income Tax Act 1961 unless the context otherwise requires the term previous year means the previous year as defined in section 3. As per Section 562VII if any gift received from relative whic. 2017-18 the penalty shall be 50.

Valuation as to living accommodation. Personal Income Tax Act CHAPTER P8 PERSONAL INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1. 11- You will have to cough up 100 to 300 per cent of tax due as penalty for concealing income WEF.

General provisions as to valuation of benefits. Kāinga OraHomes and Communities Act 2019 2019 No 50. Short title extent and commencement Section 2.

The President on the 30th March 2022 and become Finance Act 2022. October 31 2021 at 820 am. Trusts Act 2019 2019 No 38.

Persons on whom tax is to be collected. CHAPTER-I Preliminary Section 1. Income Tax New Zealand Green Investment Finance Limited Order 2019 LI 2019119.

This article provides list of relatives covered Section 562VII of the Income Tax Act1961. Taxation Annual Rates for 201920 GST Offshore Supplier Registration and Remedial Matters Act 2019 2019 No 33.

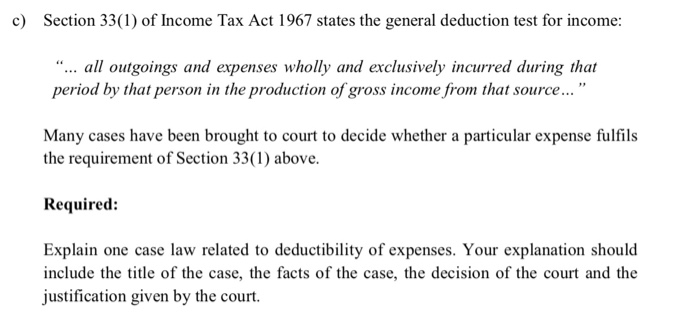

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

Income Tax Deductions Section 80c To 80u Finance Tool Business Tax Deductions Small Business Tax Deductions Tax Deductions

Title Master Guide To Income Tax Author T G Suresh Publisher Lexisnexis 4th Edition 2017 Type Soft Cover Price Rs 115 Income Tax Taxact Income

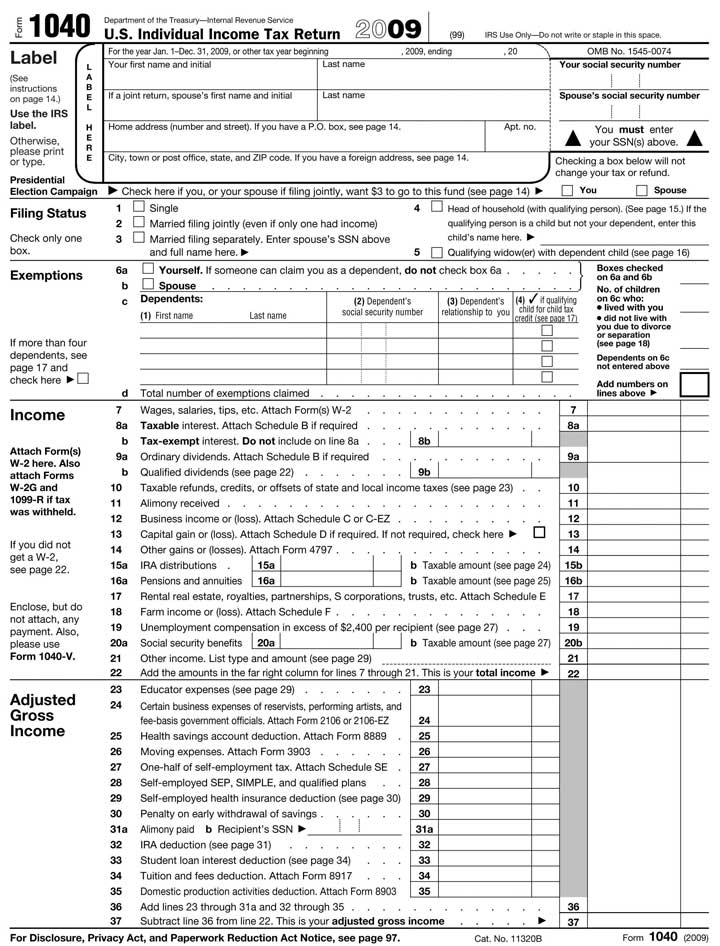

What Is The Difference Between Irs Forms 1040ez And 1040a Irs Forms Tax Forms Tax Return

Best Proprietorship Registration At Kolkata Income Tax Return Income Tax Return Filing Income Tax

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

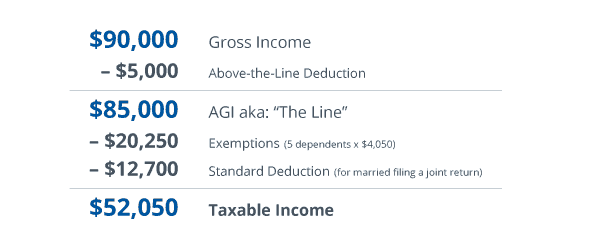

Tax Exemptions Deductions And Credits Explained Taxact Blog

The Income Tax A Study Of The History Theory And Practice Of Income Taxation At Home And Abroad Seligman Edwin Robert Anderson 1861 1939 Free Download Income Tax Income Theories

9 Most Common Overlooked Tax Deductions Freedom In A Budget Filing Taxes Tax Deductions High Interest Savings Account

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Our Comprehensive Income Tax Knowledge Book Available At A Nominal Annual Subscription Fee Of Rs 999 Here Are The Unique Fe Income Tax Infographic Tax Rules

Best Respond To Tax Notice At Kolkata Filing Taxes Bookkeeping Services Income Tax Return

The U S Federal Income Tax Process

Pin By Vipin Kumar On Vipin Kumar Coding Qr Code Enhancement

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

Income Tax Return Tax Return Bank Of America